Page 35 - Nexia SAB&T Business in South Africa Guide 2024

P. 35

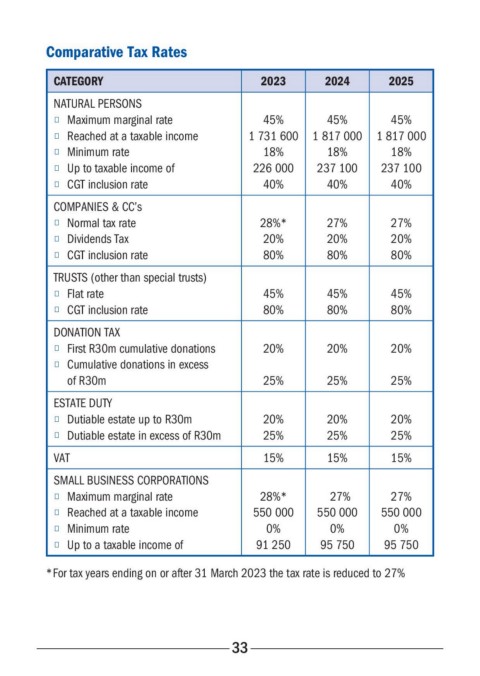

Comparative Tax Rates

CATEGORY 2023 2024 2025

NATURAL PERSONS

■ Maximum marginal rate 45% 45% 45%

■ Reached at a taxable income 1 731 600 1 817 000 1 817 000

■ Minimum rate 18% 18% 18%

■ Up to taxable income of 226 000 237 100 237 100

■ CGT inclusion rate 40% 40% 40%

COMPANIES & CC’s

■ Normal tax rate 28%* 27% 27%

■ Dividends Tax 20% 20% 20%

■ CGT inclusion rate 80% 80% 80%

TRUSTS (other than special trusts)

■ Flat rate 45% 45% 45%

■ CGT inclusion rate 80% 80% 80%

DONATION TAX

■ First R30m cumulative donations 20% 20% 20%

■ Cumulative donations in excess

of R30m 25% 25% 25%

ESTATE DUTY

■ Dutiable estate up to R30m 20% 20% 20%

■ Dutiable estate in excess of R30m 25% 25% 25%

VAT 15% 15% 15%

SMALL BUSINESS CORPORATIONS

■ Maximum marginal rate 28%* * *27% 27%

■ Reached at a taxable income 550 000 550 000 550 000

■ Minimum rate 0% 0% 0%

■ Up to a taxable income of 91 250 95 750 95 750

* For tax years ending on or after 31 March 2023 the tax rate is reduced to 27%

33