Page 36 - Nexia SAB&T Property & Tax Guide 2022

P. 36

develop and provide a dispute resolution service, and to provide education and documentation

to owners, occupiers, executive committees as regards their rights and obligations.

APPLICATIONS FOR RELIEF TO THE CSOS

Any person may make an application to CSOS for dispute resolution, if such person is

a party to or affected materially by a dispute (the relief is therefore available to persons

such as tenants, owners, trustees etc.). The grounds on which such an application may be

made include: financial issues, behavioural issues, scheme governance issues, meetings,

management services, any works pertaining to private areas and common areas, and any

general and other issues.

CONCILIATION, ADJUDICATION, APPEAL

On acceptance of an application and after receipt of any submissions from affected persons,

or responses from the applicant, if the Ombud considers that there is a reasonable prospect

of a negotiated settlement of the dispute, he must refer the matter to conciliation.

Should conciliation fail, the Ombud must refer the application, together with any submissions

and responses thereto, to an adjudicator, who may make an order to dismiss the application,

or grant or refuse each part of the relief sought by the applicant, or an order requiring a person

to act, or to refrain from acting in a specified way.

An applicant, the association or any affected person who is dissatisfied by an adjudicator’s

order, may appeal to the High Court, but only on a question of law.

OMBUD SERVICE FEES

The fee for applying to the Ombud to resolve a dispute is just R50, and once it reaches

adjudication, R100 is payable. A person whose monthly net household (gross income less

PAYE) income is below R5 500 is entitled to a 100% waiver of application and adjudi-

cation fees.

SCHEME LEVIES

The CSOS is also funded by a small levy attached to every community scheme’s levy payment,

payable on a quarterly basis, commencing January 2017.

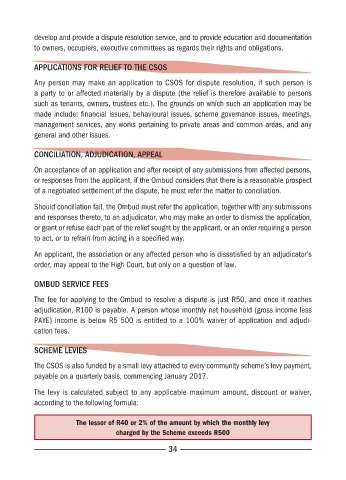

The levy is calculated subject to any applicable maximum amount, discount or waiver,

according to the following formula:

The lessor of R40 or 2% of the amount by which the monthly levy

charged by the Scheme exceeds R500

34