Page 10 - Nexia SAB&T Property & Tax Guide 2022

P. 10

vacated due to the intended acquisition of a new primary residence, the residence

being erected on land acquired, the residence being accidently rendered uninhabitable

or the death of that person, it will not be seen as an absence from the residence.

◆ When the residence is used partially for residential and partially for business purposes

an apportionment must be done.

◆ If a person is absent from his residence for a continuous period of 5 years or less and

lets the premises during this time, the absence will be ignored if the person stayed in

the residence for a period of at least one year before and after the period it was let, no

other residence was treated as a primary residence during this period and the person

was absent from the residence due to being absent from South Africa or was employed

or engaged in a business in South Africa at a location more than 250 kilometers from

the residence.

◆ Where the residence is more than 2 hectares in size, the exemption only applies to the

gain made on the residence and 2 hectares, provided that the land is used mainly for

domestic or private purposes together with the residence and the land is disposed of

at the same time and to the same person who buys the residence (this land could be

unconsolidated and next to the residence to qualify).

WITHHOLDING TAX ON ACQUISITION OF PROPERTY FROM NON-RESIDENT

The purchaser must withhold CGT on the purchase price where assets are purchased from a

non-resident except where the amount payable by the purchaser is less than R2 million. The

amount withheld is an advance tax in respect of the sellers’ liability for CGT. This withholding

tax is not a final tax and is merely a prepayment of the expected CGT.

If the purchaser is a resident withholding tax must be paid within 14 days from the date on

which the seller was paid and if the purchaser is a non-resident, within 28 days.

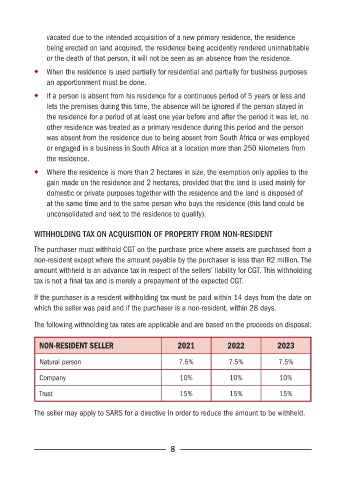

The following withholding tax rates are applicable and are based on the proceeds on disposal:

NON-RESIDENT SELLER 2021 2022 2023

Natural person 7.5% 7.5% 7.5%

Company 10% 10% 10%

Trust 15% 15% 15%

The seller may apply to SARS for a directive in order to reduce the amount to be withheld.

8