Page 10 - Nexia SAB&T Property and Tax Guide 2025

P. 10

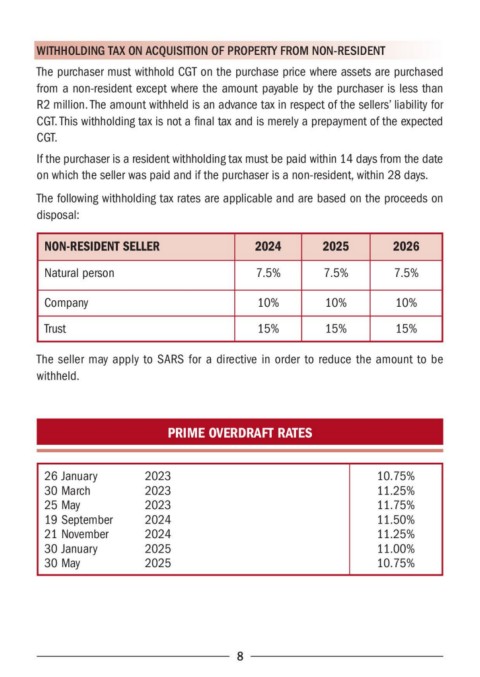

WITHHOLDING TAX ON ACQUISITION OF PROPERTY FROM NON-RESIDENT

The purchaser must withhold CGT on the purchase price where assets are purchased

from a non-resident except where the amount payable by the purchaser is less than

R2 million. The amount withheld is an advance tax in respect of the sellers’ liability for

CGT. This withholding tax is not a final tax and is merely a prepayment of the expected

CGT.

If the purchaser is a resident withholding tax must be paid within 14 days from the date

on which the seller was paid and if the purchaser is a non-resident, within 28 days.

The following withholding tax rates are applicable and are based on the proceeds on

disposal:

NON-RESIDENT SELLER 2024 2025 2026

Natural person 7.5% 7.5% 7.5%

Company 10% 10% 10%

Trust 15% 15% 15%

The seller may apply to SARS for a directive in order to reduce the amount to be

withheld.

PRIME OVERDRAFT RATES

26 January 2023 10.75%

30 March 2023 11.25%

25 May 2023 11.75%

19 September 2024 11.50%

21 November 2024 11.25%

30 January 2025 11.00%

30 May 2025 10.75%

8